Bitcoin halving is a significant event in the Bitcoin ecosystem. It impacts miners, potentially influences the price of Bitcoin, and plays a role in controlling inflation.The most recent halving event happened on April 19, 2024.

Lets talk – first thing first – Why it matters to know about bitcoin

Costly things matters in our ecosystem, today (21 April 2024), the value of one bitcoin is approximately 64983 $. This is humongous value that cannot be overlooked. Bitcoin is a major cryptocurrency, and its fluctuations can have a ripple effect on the entire cryptocurrency market. Keeping updated with Bitcoin price movements helps us stay informed about broader trends in the crypto space.

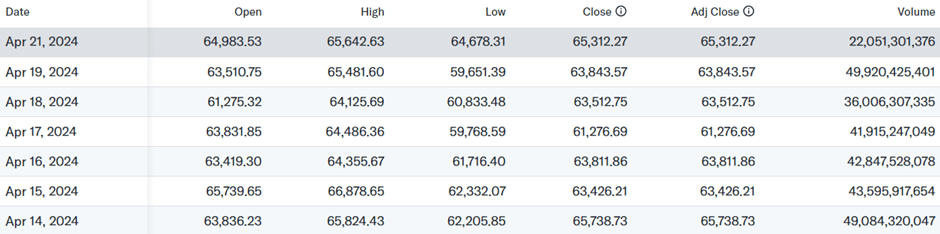

We must know that bitcoin is a volatile asset and its price can fluctuate significantly in a short period. The fluctuation in the price for last 7 days is as follow (source : https://finance.yahoo.com/)

Bitcoin ecosystem is constantly evolving, with new technologies and applications being developed all the time.

Lets understand Bitcoin Ecosystem

The Bitcoin ecosystem refers to the network of technologies (blockchain), participants (miners and holders), and processes(mining nodes) that works in collaboration to make Bitcoin function. These complex web elements work together to ensure the smooth operation of this digital currency. This ecosystem ensures the security, transparency, and efficiency of Bitcoin transactions. Each participant within the ecosystem contributes to its smooth operation and evolution.

How this ecosytem works

When a user wants to send Bitcoin to another user, they broadcast the transaction to the network. Miners pick up the transaction and compete to solve a complex mathematical puzzle. The first miner to solve the puzzle validates the transaction and adds it to a new block on the blockchain. Other nodes on the network verify the new block and the transaction within it. If everything is valid, the new block is added to the blockchain, and the transaction is considered complete. The successful miner receives a reward in newly minted Bitcoins for verifying the block. Regulations around Bitcoin and cryptocurrencies are continously developing, and this can impact the ecosystem.

Bitcoin halving ? What is it –

Bitcoin halving is a programmed event within the Bitcoin network that cuts the reward for mining new bitcoins in half, roughly every four years. It essentially reduces the rate at which new bitcoins are created and enter circulation. Miners solve complex math problems to verify Bitcoin transactions. As a reward they are given a certain number of bitcoins for each block they successfully mine. After a halving event, this reward gets cut in half.

The halving event occurs approximately every 210,000 blocks mined, which roughly means 10 minutes to mine a block, this translates to a halving roughly every four years. The most recent halving event happened on April 19, 2024.

Bitcoin halving ? What are the intentions of halving

As said that Bitcoin has a fixed maximum supply of 21 million coins. The halving mechanism helps control inflation by gradually reducing the rate at which new Bitcoins enter circulation. This, in theory, helps maintain the value of existing Bitcoins over time. This helps control inflation in the long run, potentially making Bitcoin more attractive as a store of value.

The following chart provides an overview of Bitcoin’s halving history.

| Halving Event | Date (UTC) | Pre-Halving Block Reward |

| 1st Halving | Nov 28, 2012 | 50 |

| 2nd Halving | July 9, 2016 | 25 |

| 3rd Halving | May 11, 2020 | 12.5 |

| 4th Halving | April 19, 2024 | 6.25 |

Does halving impact the bitcoin ecosystem anyway ?

The impact of Bitcoin halving on us depends on whether you’re a miner or someone who uses Bitcoin for transactions. In general, the direct impact of halving is likely to be minimal but this impact can be indirect and play out over time.

The primary effect of halving is that it cuts the block reward for miners in half. This means fewer new bitcoins enter circulation, causing a decrease in supply. In theory, with a reduced supply and constant demand, the price of Bitcoin could increase. Also since with every halving, miner receive fewer Bitcoins for their work. This can make mining less profitable, especially for those with less efficient hardware it may forced to shut down because the mining cost may overpass the reward earned.

The main impact of halving is likely felt in the long term. By design, halvings gradually slow down the creation of new coins. This controlled inflation could contribute to Bitcoin’s value as a store of value over time. However, it can be a talking point for those interested in cryptocurrency and potentially influence the price of Bitcoin, which some people hold as an investment.

Is there any other cryptocurrency also being halved

There are several cryptocurrencies other than Bitcoin that utilize a halving mechanism. The reasons other cryptocurrencies adopt halving mechanisms are similar to Bitcoin’s goals i.e. reducing the rate at which new coins enter circulation, some examples are:

Litecoin (LTCLitecoin halves its block reward every 840,000 blocks, which translates to roughly every four years similar to Bitcoin, but at a faster pace.

Dash (DASH): Dash’s block reward halves every 210,000 blocks, just like Bitcoin.

Zcash (ZEC): Their block reward halves roughly every four years, similar to Bitcoin and Dash.

Stay Connected

Ashish Seth

One thought on “Bitcoin Halving”